Industry News 2022/11/30

News 1

November 2022 zinc price shock rebound, as of November 30, Shanghai zinc main contract price of 23,820 yuan/ton, compared with the November 1 price of 22610 yuan/ton, an increase of 5.35%. The biggest reason for this zinc price increase is: the central bank announced a downgrade to release a 500 billion margins, real estate support policies continue to be introduced, and favorable non-ferrous metals. Together with the epidemic has affected the transportation of zinc ingots, resulting in the spot inventory has been at a low level and demand exceeding supply, resulting in zinc prices have been picking up.

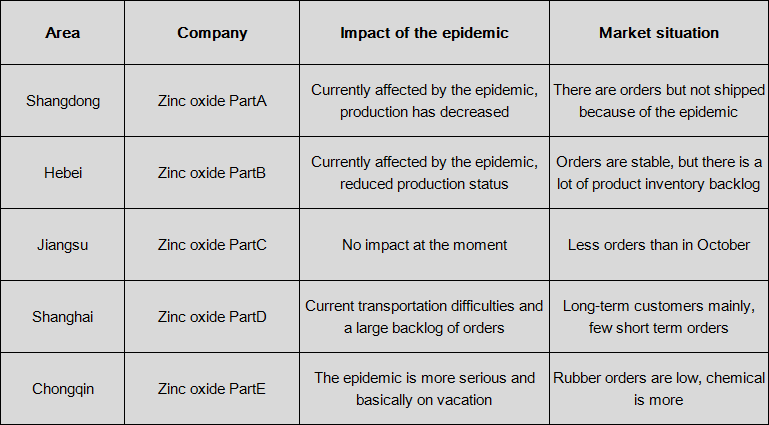

As you can see from the graph, the vast majority of zinc oxide companies have been affected, with supply falling short of expectations and orders slipping. This, coupled with the low spot zinc ingot and the high lift, has created some financial pressure on downstream.

From the raw material side: At present, zinc ingot spot lift remains high and inventory is at a low level. Producers generally have a reduced number of stockpiles and increased stockpile costs. In order to reduce costs and improve profits, companies have increased their purchases of zinc slag, but the current zinc plant start-up rate is less than expected, and zinc slag supplies are also low.

From the demand side: the rubber industry started to work last week, but the recent epidemic is again frequent, forming a certain impact on the traditional rubber and ceramic industries. In order to ensure orders, many zinc oxide producers began to specialize in orders for chemical products such as phosphating solution, and the current market has turned better.

Overall: The overall zinc oxide market was weak this week, but the downstream explored new chemical industries. However, the overall orders of zinc oxide enterprises decreased, coupled with the rebound in raw material prices, production generally decreased and the start-up rate remained low. In the short term, zinc prices are expected to continue to shake down in the short term, and the overall price trend of zinc oxide is less variable.

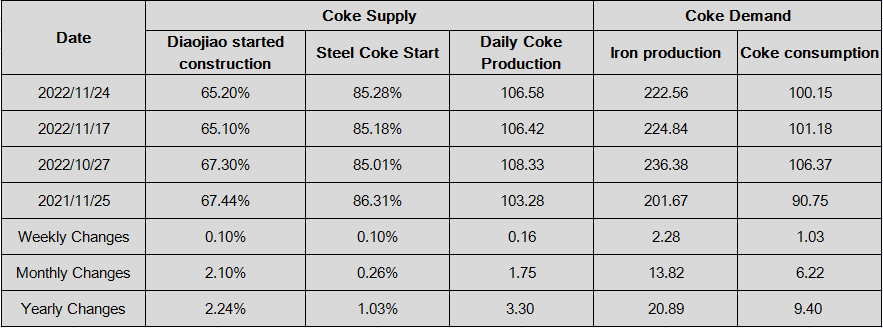

Although there was a small increase in coke supply last week, the overall coke supply is still at a low level. The main impetus for coke production reduction is still the spontaneous production reduction caused by losses. From the perspective of demand, steel mills are still reducing production. Last week, Mysteel researched 247 steel mills and their iron output was 2.2256 million tons, minus 22.8 million tons week-on-week, but the loss of steel mills has been eased. Limited impact, so continue to expand the production cut space is not much, demand is expected to be relatively stable or a small decline, into December and even a certain amount of resumption is expected. As far as the daily production and consumption data of both coke and steel are concerned, the data performance is relatively tight and balanced, and it can even be said that the coke is a bit more supportive, and the current production reduction action of coke enterprises is higher than that of steel mills.

The above content is excerpted from:https://m.mysteel.com/22/1130/10/6D3AF414446A4D53_abc.html

News 2

In November, coke finally rose at the end of the month and the 24th landed the first round of upward adjustment, but the plight of coke enterprises did not improve after the first round of increase landed, the reality of losses has always existed, coal prices rose in time and space before coke, the pressure of costs forced coke enterprises to continue to raise to change the current status quo of losses. Last week, the national average profit per ton of coke in Mysteel's research was -141 yuan/ton, and coke enterprises are still suffering from serious losses. Since the end of last week, coke enterprises have been sending letters requesting for the second round of coke increase, and the range is still 100/110 yuan/ton. The current view on this round of increase is that it can be landed, but it is difficult to be landed, and there is room for gaming on the landing time.

The above content is excerpted from:https://m.mysteel.com/22/1130/09/612B5E91173F7AB7_abc.html

Send Email

Send Email caitlynqiu

caitlynqiu